Thursday, September 19, 2024 by Shelley Hirst

From a vendor's vantage point, channel partners play an irreplaceable role in extending reach, driving sales, and fortifying market presence.

As the landscape of B2B buyer behaviour evolves, there's a growing realisation of the need to recalibrate and strengthen the vendor-partner alliance, especially regarding lead generation.

Today's B2B buyer is a far cry from those of the past. Empowered by technology and driven by a wealth of information, they embark on intricate buying journeys. Their decision-making process involves meticulous research, peer reviews, and an expectation for a more personalised buying experience and forged relationships.

Whether embarking on net new lead generation or leveraging existing relationships, marketing and sales programmes need to adapt to echo this sophistication and agility.

The channel partner challenge

One of the noteworthy challenges facing channel partners is the shift from traditional, quarterly-focused outreach to a more consistent, continual engagement model. Continuous engagement, sustained by relevant content and meaningful interactions, should be the gold standard.

However, it's evident that many partners might not be fully equipped for such a dynamic approach. The cadence, resources, and strategic vision required for continual outreach can be demanding especially in cases where sales and marketing focus needs to be on multiple vendors.

As we look forward to a year where budgets might be tighter and resources more scarce, it’s time to look at ways to reduce workload whilst delivering back more value and ROI.

Investing in growth through channels

From a vendor's perspective, the path to mutual growth with partners in these challenging times can be charted through the following strategies:

- Education and training: Although education and training is available in spades from vendors, far fewer offer channel partners insight into modern B2B buying behaviour and their approach to it. Investing in training sessions, workshops, and seminars can go a long way in equipping partners with the requisite knowledge to enable them to gain more from their efforts.

- Shared resources: Recognising that partners might be less equipped for continual outreach, vendors can consider sharing marketing resources, services, tools, or even personnel to bridge this gap. This collaborative approach ensures consistent engagement and strengthens the bond between vendors and partners.

- Data-driven decisions: With constrained budgets, it's essential to maximise ROI. With the right programmes and compliance that allow partners to leverage their data, vendors can support partners by providing insights from data analytics, ensuring that outreach efforts are targeted and effective.

- Feedback loop: Establishing a robust feedback mechanism can help vendors understand the unique challenges faced by partners. This two-way communication can lead to innovative solutions tailored to the evolving market landscape.

- Flexible financial models: Maybe it’s time to question how MDF is applied. Traditional quarterly approaches to funding don’t translate into buying cycles meaning thousands of leads never reach their full potential. By understanding the downsides to this approach, vendors might explore more flexible financial models or incentives that can support partners in their outreach efforts, ensuring that growth isn't stymied by quarterly effort and budgetary certainty.

In conclusion

The dynamics between vendors and channel partners are poised at an interesting juncture. By recognising the shifts in B2B buying behaviours and the challenges of continual outreach, vendors have a unique opportunity.

By adapting their strategies, investing wisely, and fostering a spirit of collaboration, vendors can ensure that their relationships with channel partners not only remain robust but also become a potent catalyst for growth in challenging times.

If this makes sense to you ......

Take a small step. Ask us to show you how Market Activation™ will help amplify your brand, identify buyers with purchasing intent and create better-informed sales conversations!

It can be a complete enabler for small/newly funded businesses or as a programme that's part of a wider demand generation strategy.

Vendors looking to support their partner channels in their demand-creation efforts find it particularly beneficial if they build it into their channel programmes.

Forward-thinking distributors wishing to offer value to vendors and partners by engaging and managing relationships directly with buyers are also creating interest.

And great news for the budget holders - depending on where you sit there are models some customers have adopted that have made it cost-neutral or revenue-positive at source.

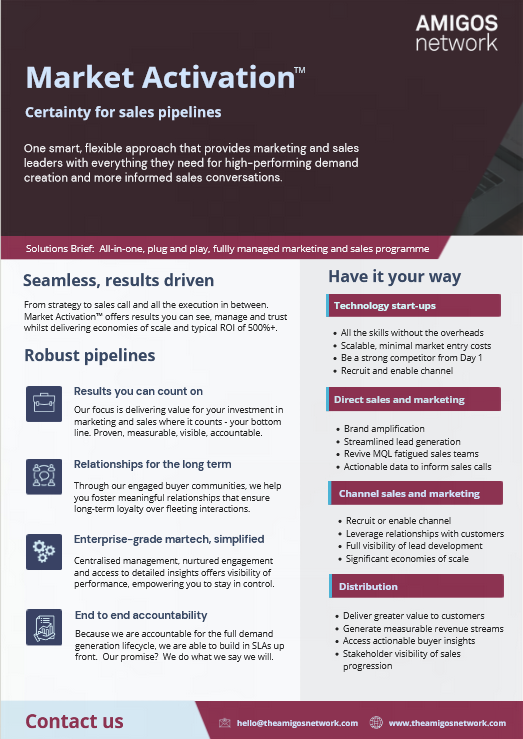

Market Activation™ Solution Brief

Some more detail about how we approach demand generation to get outstanding results.

For more information and a live demonstration of lead progression and pipeline visibility, please book some time with us to show you.

Download (1.3 MB)Frequently Asked Questions

Market Activation identifies in-market buyers (via intent data, behavioural signals) and immediately engages them with tailored outreach (nurture tracks, one-to-one advisor sessions, community invites).

Demand Engine: Targeted outreach (email, ads, sponsorships) that scores clicks → qualified leads → sales-ready appointments.

Performance Dashboard: Real-time visibility into open rates, CTOR, CPL and lead progression via our online sales portal.

Content Amplification: Thought leadership shared in The Amigos Network drives deeper engagement and social proof.

Peer Validation: Prospects get candid feedback from peers on your solutions, shortening the evaluation cycle.

Pipeline Catalysis: Warm introductions and referral paths within the community fuel high- intent conversations.

- Top-of-Funnel: Build credibility through community content and events.

- Mid-Funnel: Leverage peer case studies, expert Q&As, and live demos to answer deep technical questions.

- Bottom-of-Funnel: Invite high-intent members to advisory councils or private 1:1 sessions, often the final nudge before purchase.

- Interesting content: We originate, curate, and syndicate different types of content we know our audiences want to engage with and tell them it’s there.

- Sponsored content: We use sponsored content to drive engagement with individual brands.

- Promotion: We promote that content via multiple channels such as email, social media, YouTube, and so on.

- Identification: We ingest company-level engagement signals and combine it with known contacts that may be researching key topics.

- Segmentation: Members are bucketed by level of intent (high, medium, low) plus ICP fit and company size.

- Activation: High-intent members receive prioritised community invitations (events, focus groups, product deep-dives) to accelerate deals.

- Purchased data highlights who’s in-market.

- Community engagement reveals what questions they’re asking, so your nurture can be hyper-relevant.

- Result: A 2–3× lift in meeting acceptance and pipeline velocity vs. cold outreach alone.

- Marketing owns the nurture tracks, community invites, educational content, and event promos.

- Sales intervenes only at “high-intent + active community engagement” thresholds, with account-specific demos and peer introductions.

- Outcome: Fewer wasted calls and a higher win rate on truly qualified opportunities.

- Engagement Metrics: Community log-ins, event attendance, content downloads.

- Intent Conversion: % of intent-scored members who join private roundtables or request demos.

- Pipeline Velocity: Time from first community touch to opportunity creation.

- Revenue Impact: Contribution of community-sourced deals to overall bookings.

- Average Weekly Open Rate: 40%

- Average Weekly Click-to-Open Rate: 70%

- Average Cost-per-Lead: £45

- Minimum ROI: 500%

- Average Dwell Times: 1 minute 45 seconds