Monday, April 15, 2024 by Shelley Hirst

Changes in B2B technology buyer behaviour has evolved over recent years and has had substantial effects on the traditional dynamics between marketing and sales teams.

This evolution is particularly evident in the ways these teams manage and react to Marketing Qualified Leads (MQLs). Often viewed through a lens of friendly rivalry, the relationship between these departments is crucial in navigating the complexities of lead generation and subsequent handling.

This tension often revolves around the quality and readiness of leads passed from marketing to sales, with sales teams frequently expressing concerns over the relevance and conversion potential of these leads.

The changing landscape requires both departments to adapt their strategies to better align with the new behaviors of buyers. This adaptation is essential for effectively managing the flow and quality of MQLs, ensuring that both marketing and sales can work together more harmoniously and effectively.

Putting some of these stand-out points into context, we aim to offer insights and solutions to bridge the gap between marketing and sales.

1. Shift in sales dynamics

The traditional sales model, heavily reliant on personal relationships and direct sales tactics, is being upended by buyers who prefer digital research and self-service tools. This shift challenges the sales team’s perception of MQLs, as leads now require a different engagement strategy that aligns with their independent research and decision-making process.

Sales teams must recognise that today's great MQLs are backed by data forensics which is self-directed from intent markers from the audience, necessitating a follow-up strategy that acknowledges their stage in the buying journey. By taking time to digest what the data is telling them will take sales longer, but has the potential to lead to a much warmer, better qualified conversation.

2. Generational change in decision-makers

With millennials becoming the key decision-makers in B2B purchases, their preference for digital communication and scepticism towards sales pitches demand a reassessment of what qualifies as a high-regard MQL.

Marketing teams should leverage digital and social media platforms extensively to generate leads, ensuring that the leads are in tune with the preferences of millennial decision-makers.

Sales teams, in turn, must adjust their engagement strategies to be more consultative and less transactional, respecting the buyer's desire for authenticity and transparency.

3. Preference for video and interactive content

The increasing preference for video and interactive content among B2B buyers indicates that traditional forms of content might not hold the same value in qualifying leads. Marketing teams should focus on creating engaging video content and interactive tools that cater to this demand, potentially increasing the quality and engagement level of MQLs.

Sales teams should be equipped to leverage these content forms in their follow-ups, providing a more dynamic and engaging buyer experience.

4. The role of peer recommendations

The significant influence of peer recommendations and reviews on B2B buying decisions suggests that marketing and sales need to collaborate closely on customer advocacy programmes.

Marketing can work on amplifying positive customer testimonials and managing online reviews to generate high-quality MQLs. Sales teams should then incorporate these testimonials and reviews into their sales process, reinforcing the credibility and trustworthiness of their solution.

5. Post-purchase experience

The importance of post-purchase experience in influencing future purchasing decisions highlights the need for both marketing and sales to focus on customer success, beyond the initial conversion.

By jointly developing strategies for ongoing engagement and support, marketing and sales can ensure that customers feel valued and supported, increasing the likelihood of repeat business and referrals, which are often regarded as high-quality leads.

6. Sustainability and corporate responsibility

As sustainability becomes a deciding factor in B2B purchases, marketing and sales must consider how they align their messaging and practices around their company’s sustainability efforts.

This alignment can enhance the perceived value of MQLs, as leads generated from this narrative are more likely to be in alignment with the company's values and therefore more likely to convert.

Conclusion

Addressing the standoff between marketing and sales over MQLs requires a deep understanding of the changing B2B buyer landscape and an adaptive, collaborative approach. By recognising and adapting to the shift in buyer behaviour, preferences, and decision-making processes, both departments can work together to refine lead qualification criteria, tailor engagement strategies, and ultimately improve the conversion rate of MQLs into sales.

Paying lip service to the problems many businesses claim they recognise, yet fail to fully address, will not change the lacklustre pipeline development and conversion, making ROI a constant budget vs revenue challenge.

A collaborative effort not only bridges the gap between marketing and sales but also aligns with the evolving expectations of B2B technology buyers, ensuring a more cohesive and successful sales process.

To learn more about how Market Activation embraces Social Selling as part of a seamless sales and marketing growth strategy, get in touch.

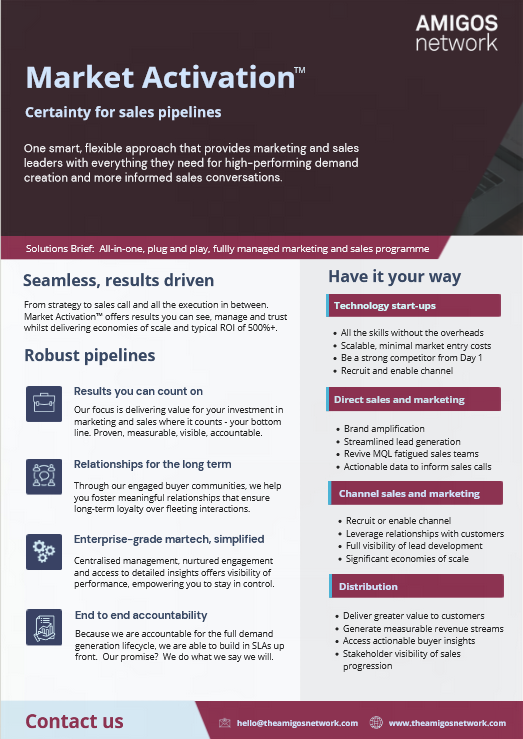

Market Activation™ Solution Brief

Some more detail about how we approach demand generation to get outstanding results.

For more information and a live demonstration of lead progression and pipeline visibility, please book some time with us to show you.

Download (1.3 MB)Frequently Asked Questions

Market Activation identifies in-market buyers (via intent data, behavioural signals) and immediately engages them with tailored outreach (nurture tracks, one-to-one advisor sessions, community invites).

Demand Engine: Targeted outreach (email, ads, sponsorships) that scores clicks → qualified leads → sales-ready appointments.

Performance Dashboard: Real-time visibility into open rates, CTOR, CPL and lead progression via our online sales portal.

Content Amplification: Thought leadership shared in The Amigos Network drives deeper engagement and social proof.

Peer Validation: Prospects get candid feedback from peers on your solutions, shortening the evaluation cycle.

Pipeline Catalysis: Warm introductions and referral paths within the community fuel high- intent conversations.

- Top-of-Funnel: Build credibility through community content and events.

- Mid-Funnel: Leverage peer case studies, expert Q&As, and live demos to answer deep technical questions.

- Bottom-of-Funnel: Invite high-intent members to advisory councils or private 1:1 sessions, often the final nudge before purchase.

- Interesting content: We originate, curate, and syndicate different types of content we know our audiences want to engage with and tell them it’s there.

- Sponsored content: We use sponsored content to drive engagement with individual brands.

- Promotion: We promote that content via multiple channels such as email, social media, YouTube, and so on.

- Identification: We ingest company-level engagement signals and combine it with known contacts that may be researching key topics.

- Segmentation: Members are bucketed by level of intent (high, medium, low) plus ICP fit and company size.

- Activation: High-intent members receive prioritised community invitations (events, focus groups, product deep-dives) to accelerate deals.

- Purchased data highlights who’s in-market.

- Community engagement reveals what questions they’re asking, so your nurture can be hyper-relevant.

- Result: A 2–3× lift in meeting acceptance and pipeline velocity vs. cold outreach alone.

- Marketing owns the nurture tracks, community invites, educational content, and event promos.

- Sales intervenes only at “high-intent + active community engagement” thresholds, with account-specific demos and peer introductions.

- Outcome: Fewer wasted calls and a higher win rate on truly qualified opportunities.

- Engagement Metrics: Community log-ins, event attendance, content downloads.

- Intent Conversion: % of intent-scored members who join private roundtables or request demos.

- Pipeline Velocity: Time from first community touch to opportunity creation.

- Revenue Impact: Contribution of community-sourced deals to overall bookings.

- Average Weekly Open Rate: 40%

- Average Weekly Click-to-Open Rate: 70%

- Average Cost-per-Lead: £45

- Minimum ROI: 500%

- Average Dwell Times: 1 minute 45 seconds