Friday, May 26, 2023 by Shelley Hirst

Introduction

2022: A sales and marketing agency rocked up at a corporate headquarters to meet with business leaders who have a considerable budget to allocate to demand generation. The agency proclaims it will turn the business into gold because they’re experts in creating the exact type of leads the business desires. They promise to supply them with endless supplies of MQLs, the value of which is invisible to those who are too stupid or incompetent to understand.

This sounds so amazing that the business hires them. The agency sets to work writing content, building websites, setting up email campaigns, creating social outreach, events and telemarketing.

The agency is as good as its word and presents copious amounts of MQLs. Even though the business has yet to make any sales from them, it carries on as it doesn’t wish to appear foolish or incapable of converting them to actual business. After all, there are so many MQLs, some of them must be worthwhile, right?

Fast forward to 2023: At the end of the programme, the results are announced and it’s clear for all to see that all is not well. It’s had limited success in terms of actual sales revenue and has underperformed in delivering adequate ROI.

What now?

If I revert to the original fairy tale, the Emperor continued to parade through the town naked, so as not to lose face because he spent large amounts of money on clothes that didn’t exist (details in a video at the foot of this blog)

In business, getting naked isn’t an option, but neither is poor ROI. It’s also unrealistic for marketing to claim success based on MQLs alone as they are only part of a complex process, not least including a high degree of data forensics and sales engagement.

Getting Real: Vanity MQLs

Any marketing team worth their salt can create MQLs, but the tendency is to place much of the emphasis on the last ‘click’ or ‘download’. Whether this is one or multi-channel outreach, it makes the performance all about a single point(s) in time. By associating buyer engagement with an individual piece of collateral rather than a series of indicators over time across different communication channels, there’s no demonstration of the level of intent and, crucially, at what stage buyers are in their purchasing journey.

Even businesses with internal teams and sophisticated automation platforms deliver leads to sales teams containing mass-scoring metrics, rather than a more scientific assessment of all-funnel attributes.

The result is Vanity MQL’s, where volume is vaunted over quality.

Sales and their MQL apathy

Let’s be honest, how interested are sales teams in these leads and how productive they are as a result of receiving them?

Handing over vanity MQLs too early frustrates them because these leads still need too much work to close. Leads that are only one step beyond “cold calling a cold list” also negate the effort and money allocated to creating great content to drive engagement in the first place.

All in all, it’s a path to diminishing returns.

Mitigating MQL Vanity with Data Science

On the other hand, passing across leads with actionable insights and measurable intent attributable throughout the whole funnel makes it easier for sales to convert, forecast, and be accountable for their number.

Never before has insight into a buyer’s digital journey been more important. So as you’d expect, there are a plethora of tools out there to blow your mind when looking at potential forensics available. However, industry reports indicate that even if businesses have sophisticated automation tools in-house, they are paying expensive licenses, while only using around 30% of their capability.

Intent or not?

In a nutshell, there are no shortcuts. Even harnessing the growing trend of purchasing intent data from companies who track search terms around chosen topics will have limited success if not partnered with complementary outreach to drive onward engagement. It’s great to kickstart the top of the funnel but will degenerate to tumbleweed if leads aren’t nurtured.

Whether demand creation budgets are large or small, unless automation is used to track, analyse and report on every digital interaction, then any investment in data, content and outreach to deliver ‘MQLs’ is a diminishing return.

Whilst every business is different and there are many pitfalls to resolve before yielding high returns, here’s our simple checklist to see if you’re likely to be getting volumes of Vanity MQLs, even after setting up lead scoring protocols.

What does it really mean to have a sales-ready lead?

Results don't discriminate

Whether a budget is large or small, it's what you do with it that counts. Everyone can now have a slice of the intelligence pie. These include

- Whatever you're doing in-house, invest in the proper levels of expertise to ensure existing systems and licenses are being optimised. Continually monitor the market for new technology that can be integrated to offer greater visibility, compliance and control over data.

- Ensure sales and marketing staff are trained to use and understand the information systems present to them.

- Get the last mile fully covered. If sales aren't fully on board with what's expected of them in the hand-off process, any effort made to achieve digital engagement will fall if someone doesn't pick up the phone and have the right conversation.

- Offload the responsibility for the heavy lifting. Join the growing trend and take demand creation as a managed service. Let an experienced, knowledgeable team be accountable for delivering guaranteed high-intent leads. This is made possible by taking ownership of the entire process, including data management, systems, intelligence, content creation and/or delivery via multiple channels, social connections and reporting.

PS – Don’t forget Channel Partners

As a vendor or distributor, even if you think you’ve got all this covered, turn your thoughts to where you invest marketing £'s with your channel partners. Whilst recognising it’s a key role of channel partners to deliver sales to their vendors and distributors, the challenge is getting visibility of the investment made in the development of MQLs that result in SQLs and ultimately, how you measure ROI.

The majority of partners don't have sufficient resources, technology or processes in place to deliver what's required in modern demand creation for EVERY vendor in their portfolio.

With the right approach, you can turn partner MDF from a loyalty tool into a true growth generator.

Interested in seeing it in action?

Get in touch with shelley.hirst@theamigosnetwork.com

We'd be happy to demonstrate our unique approach which includes a fully managed, plug-and-play environment, visibility of end-to-end buyer journeys and more importantly, the results we are getting for our customers.

Source material: The Emperor’s New Clothes: The actual story

For anyone unfamiliar with the original Fairy Tale, here’s an overview. Or if you're a child of a 'certain' age, you may want to check out the video https://www.youtube.com/watch?v=z9mQoJU-6I0

Two swindlers arrive at the capital city of an emperor who spends lavishly on clothing at the expense of state matters. Posing as weavers, they offer to supply him with magnificent clothes that are invisible to those who are stupid or incompetent. The emperor hires them, and they set up looms and go to work. A succession of officials, and then the emperor himself, visit them to check their progress. Each sees that the looms are empty but pretends otherwise to avoid being thought a fool. Finally, the weavers report that the emperor's suit is finished. They mime-dressing him and he sets off in a procession before the whole city. The townsfolk uncomfortably go along with the pretence, not wanting to appear inept or stupid, until a child blurts out that the emperor is wearing nothing at all. The people then realise that everyone has been fooled. Although startled, the emperor continues the procession, walking more proudly than ever.

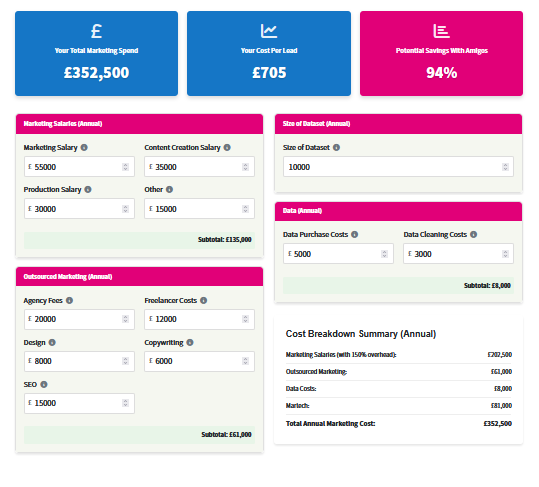

Cost Per Lead Calculator

To us, a lead is a target customer showing interest and intent through clear behavioural signals beyond a quarter.

When matched with deal sizes and conversion rates, this intel helps you prioritise high-value prospects, sharpen spend, and accelerate pipeline.

Find out more about this tried and tested formula which buys you visibility, accountability, value, across the entire programme.

Frequently Asked Questions

Market Activation identifies in-market buyers (via intent data, behavioural signals) and immediately engages them with tailored outreach (nurture tracks, one-to-one advisor sessions, community invites).

Demand Engine: Targeted outreach (email, ads, sponsorships) that scores clicks → qualified leads → sales-ready appointments.

Performance Dashboard: Real-time visibility into open rates, CTOR, CPL and lead progression via our online sales portal.

Content Amplification: Thought leadership shared in The Amigos Network drives deeper engagement and social proof.

Peer Validation: Prospects get candid feedback from peers on your solutions, shortening the evaluation cycle.

Pipeline Catalysis: Warm introductions and referral paths within the community fuel high- intent conversations.

- Top-of-Funnel: Build credibility through community content and events.

- Mid-Funnel: Leverage peer case studies, expert Q&As, and live demos to answer deep technical questions.

- Bottom-of-Funnel: Invite high-intent members to advisory councils or private 1:1 sessions, often the final nudge before purchase.

- Interesting content: We originate, curate, and syndicate different types of content we know our audiences want to engage with and tell them it’s there.

- Sponsored content: We use sponsored content to drive engagement with individual brands.

- Promotion: We promote that content via multiple channels such as email, social media, YouTube, and so on.

- Identification: We ingest company-level engagement signals and combine it with known contacts that may be researching key topics.

- Segmentation: Members are bucketed by level of intent (high, medium, low) plus ICP fit and company size.

- Activation: High-intent members receive prioritised community invitations (events, focus groups, product deep-dives) to accelerate deals.

- Purchased data highlights who’s in-market.

- Community engagement reveals what questions they’re asking, so your nurture can be hyper-relevant.

- Result: A 2–3× lift in meeting acceptance and pipeline velocity vs. cold outreach alone.

- Marketing owns the nurture tracks, community invites, educational content, and event promos.

- Sales intervenes only at “high-intent + active community engagement” thresholds, with account-specific demos and peer introductions.

- Outcome: Fewer wasted calls and a higher win rate on truly qualified opportunities.

- Engagement Metrics: Community log-ins, event attendance, content downloads.

- Intent Conversion: % of intent-scored members who join private roundtables or request demos.

- Pipeline Velocity: Time from first community touch to opportunity creation.

- Revenue Impact: Contribution of community-sourced deals to overall bookings.

- Average Weekly Open Rate: 40%

- Average Weekly Click-to-Open Rate: 70%

- Average Cost-per-Lead: £45

- Minimum ROI: 500%

- Average Dwell Times: 1 minute 45 seconds