Wednesday, March 29, 2023 by Shelley Hirst

Used very effectively over the years for B2C purchases, every digital move racks up intelligence for businesses trying to sell you everything from cars to jelly tots.

You’ve already worked out that having used browser search, clicked on links, and by asking Alexa, you start to see a great deal more about the things you’ve looked for online. Yet with Google processing an average of over 40K queries per second, in the B2B world, how do you filter frivolous, mindless scrolling from serious intent interactions that may want to engage with your business?

Back to Basics

B2B buyer intent data works in the same way as for B2C. It offers an aggregated set of data that shows you which companies are active in the buying cycle.

These are companies actively sending out strong signals that they are ready to buy, and soon. We term this early, mid and late intent. When analysed and processed intelligently, this behaviour offers businesses actionable insight into the activities of key decision-makers.

"Wowzers! Where do I get my hands on some of that?", said the sales team.

Hold up just one second!

Whilst I apologise for being a bit literal, it does nicely open up a proverbial can of worms that's worth consideration. What I hope to do here is to offer at least one golden nugget that will help you if you’re thinking of using intent data to inform your account-based, or any other sales and marketing strategy.

Intent Data Phase I: Acquiring it

1. It's not all about you! What are these potential prospects searching for and where are they in their journey? Understanding your point of difference has never been so important. Asking for intent prospects searching on “compliance” or “cloud”, will result in literally thousands of results that may, or may not, end up being relevant to your business.

Drill deeper, be smarter with your search and think about the long tail.

2. Companies, not people. Your purchase of intent data may only tell you which companies are looking for information, e.g. how many people within a company are looking and how often, not whom.

How are you going to get at the actual people and what are you going to do to pique their interest over that of your competitors?

3. Scrutinise results. Could intent data contain students and interns looking for information, rather than them ever being potential new customers?

Understand the behaviour and trends in what you’re looking at.

4. You’ve decided it's for you! This is not your fast route to a sale. Likely, these contacts are just at the awareness stage of their journey so sending them a few emails or calling them straight away is likely to be a turn-off. This is where your work begins in providing all manner of information designed to engage them at their pace, closely monitored by using further intent triggers throughout the process.

Buyer beware – check if data has opted in, is CTPS suppressed, etc., or you won’t be GDPR compliant if you contact them. If you already have a compliant data set, then you crossmatch it with that. If not, then you need to research it or purchase an opt-in list which will add more cost to the process.

5. Cost. It’s not cheap, so it's vital to have a proper plan around what you’re going to do with it and what it’s going to return for you.

Cost depends on what you buy as some of it’s deemed more valuable depending on the stage of intent and the amount of information provided about the records.

Intent Data Phase II – Using it

There’s never been a truer phrase than “It’s not what you’ve got, it’s how you use it”. The correct use of the data will determine the level of success you have in sales leads.

6. Reaching out. You now know the intent, matched the people, next step is to make contact. Don’t be tempted to take shortcuts here. Sending an email and putting telemarketing on it, whilst doing a bit of InMail to connect with them on LinkedIn isn’t the best way forward. This is old-school spamming and cold calling cold lists, which should be committed firmly to the past.

If you're not prepared to create multi-channel content for every stage in the funnel, tailored to the individual's pace, then the investment in intent data probably isn't for you.

7. Intent is continual. Strike too early with a call and you’ll turn them off. Patience is needed to trigger onward intent through continual behavioural profiling until they reach a level of qualification which merits a sales call.

No more cold calling, cold lists or quarterly-based programmes.

8. Content. Data will not perform as you wish it to. Individual buyers will progress at their own pace. This requires a robust content and delivery plan. Your job is to deliver what they need at the right time from a system that automates the process.

Think beyond the quarter and always keep an eye on the next step in the messaging.

9. Automation. Managing buyer journeys isn’t easy without automation. It’s worth noting that industry figures state even those with automation in place rarely use more than 30% of their capability.

If you have it, use all its functionality. If you don’t, then look at this in tangent with your intent data purchase – it will be a good investment.

10. Visibility & Transparency. Making every engagement visible and meaningful for your internal teams is essential. Marketing needs to understand what’s working and what isn’t. For those making calls, every nugget of information is vital for a successful outcome so they need to be educated about what is available to them.

Weekly marketing to sales campaign activity briefings. Weekly sales to marketing feedback on the quality of what's been delivered.

11. Analysing intent. Is a ‘click’ on your content the result of an email security tool checking links, or is there someone there? Your system won’t know either way so this is just one example of how your results can be skewed.

Using extended tools that go beyond standard automation can tell you this, along with other behavioural trends such as dwell times on the website are required to truly reap the rewards of intent data purchase.

12. Appropriate follow-up. Forensic reporting on the data, including behavioural analysis, informs excellent sales calls. Convert more conversations by getting this bit right!

Sales and marketing have never needed to work more collaboratively (see 10 above)

13. Resource. Is your team equipped to deliver all this on a sustained basis?

14. Never end on unlucky 13. Thank you for reading our article. We specialise in using, creating, and managing buyer demand and report it as qualified high-intent leads for action by a sales team.

I'd be happy to hear from you if you have challenges around anything you’ve read here – or indeed, anything I’ve missed. Feel free to book some time in the diary for a quick chat.

How we support ambitious businesses

Market Activation is our plug-&-play service which includes everything needed achieve revenue goals. It offers access to clever thinkers & planners, technology and licenses, writers, creatives, and data analysts - all delivering on pre-agreed revenue goals. Performance management and visibility dashboards built in for guaranteed results.

It's a single methodology that can be adopted by direct and channel sales and marketing teams, new or established, enterprise, SMB or start up. It's also used for Partner recruitment and enablement by vendors who aren't ready or don't want for distribution to be in the mix.

Project based support

Of course, a managed service may not be right for you. We offer all the elements of our managed service as individual project-based engagements.

We love a challenge! If you have an itch that has been bugging you for a while, book some time with us to see if we can help using the link below.

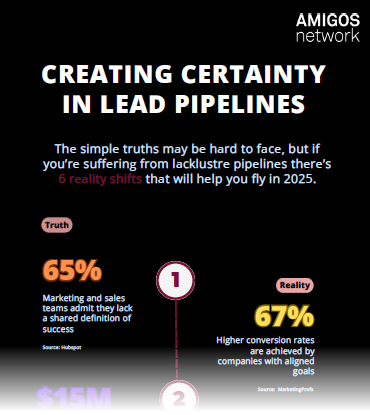

Infographic: Creating certainty in lead pipelines

The simple truths may be hard to face, but if you’re suffering from lacklustre pipelines there’s 6 reality shifts that will help you fly in 2025.

For more information and a live demonstration of lead progression and pipeline visibility, please book some time with us to show you.

Download (0.9 MB)Frequently Asked Questions

Market Activation identifies in-market buyers (via intent data, behavioural signals) and immediately engages them with tailored outreach (nurture tracks, one-to-one advisor sessions, community invites).

Demand Engine: Targeted outreach (email, ads, sponsorships) that scores clicks → qualified leads → sales-ready appointments.

Performance Dashboard: Real-time visibility into open rates, CTOR, CPL and lead progression via our online sales portal.

Content Amplification: Thought leadership shared in The Amigos Network drives deeper engagement and social proof.

Peer Validation: Prospects get candid feedback from peers on your solutions, shortening the evaluation cycle.

Pipeline Catalysis: Warm introductions and referral paths within the community fuel high- intent conversations.

- Top-of-Funnel: Build credibility through community content and events.

- Mid-Funnel: Leverage peer case studies, expert Q&As, and live demos to answer deep technical questions.

- Bottom-of-Funnel: Invite high-intent members to advisory councils or private 1:1 sessions, often the final nudge before purchase.

- Interesting content: We originate, curate, and syndicate different types of content we know our audiences want to engage with and tell them it’s there.

- Sponsored content: We use sponsored content to drive engagement with individual brands.

- Promotion: We promote that content via multiple channels such as email, social media, YouTube, and so on.

- Identification: We ingest company-level engagement signals and combine it with known contacts that may be researching key topics.

- Segmentation: Members are bucketed by level of intent (high, medium, low) plus ICP fit and company size.

- Activation: High-intent members receive prioritised community invitations (events, focus groups, product deep-dives) to accelerate deals.

- Purchased data highlights who’s in-market.

- Community engagement reveals what questions they’re asking, so your nurture can be hyper-relevant.

- Result: A 2–3× lift in meeting acceptance and pipeline velocity vs. cold outreach alone.

- Marketing owns the nurture tracks, community invites, educational content, and event promos.

- Sales intervenes only at “high-intent + active community engagement” thresholds, with account-specific demos and peer introductions.

- Outcome: Fewer wasted calls and a higher win rate on truly qualified opportunities.

- Engagement Metrics: Community log-ins, event attendance, content downloads.

- Intent Conversion: % of intent-scored members who join private roundtables or request demos.

- Pipeline Velocity: Time from first community touch to opportunity creation.

- Revenue Impact: Contribution of community-sourced deals to overall bookings.

- Average Weekly Open Rate: 40%

- Average Weekly Click-to-Open Rate: 70%

- Average Cost-per-Lead: £45

- Minimum ROI: 500%

- Average Dwell Times: 1 minute 45 seconds