Friday, May 31, 2024 by Shelley Hirst

The distinction between inbound and outbound leads often seems clear-cut with expectations concluding inbound is the holy grail for sales.

It's because inbound leads are traditionally seen as those who find and engage with your business through organic channels, driven by interest and curiosity. On the other hand, outbound leads are those targeted directly through campaigns that include cold emails, advertisements, or direct mail.

When sales will only get out of bed for perceived inbound leads this rigid and binary distinction can create poor follow-up, waste time and missed opportunities. Factoring in the merest hint of what we know about buyer behaviour, there's a need to trust brands and acquire information at their pace. An inbound lead, especially in B2B technology sales, will undoubtedly result from awareness and visibility over time. This interplay underscores the notion that it's not merely what you do, but it’s the way you do it, that determines success.

Interest sparked by outbound

Consider an outbound campaign designed to introduce a new product or service. This might be a cold email or a highly targeted social media advertisement. Initially, this is a classic example of outbound marketing.

Although their journey began with outbound marketing, their subsequent actions classify them as inbound leads. When the campaign is compelling enough and has longevity, it sparks curiosity and prompts recipients to seek out more information independently. They might visit the company’s website, follow social media profiles, or even engage with content by downloading a whitepaper or signing up for a newsletter.

Is this an inbound lead, or are other markers of intent required?

Engagement shift from outbound to inbound

The shift from outbound to inbound is particularly noticeable when potential customers take control of their engagement. When a well-executed outbound campaign generates significant awareness and interest, prospective customers start interacting with the business’s content on their terms—reading blog posts, watching webinars, or engaging with social media posts.

This transition marks a shift in engagement dynamics: what started as an outbound effort has now fostered inbound behaviour. This engagement shift is crucial, as it indicates a deeper level of interest and a more meaningful connection with the audience.

Behaviour-based qualification

The level of engagement following an outbound touchpoint can be a strong indicator of lead qualification. When an audience engages deeply with content—such as attending webinars, participating in discussions, or repeatedly visiting the website—it demonstrates a behaviour often associated with inbound leads.

These actions show that the audience is not just passively receiving information but is actively seeking out more, indicating a higher level of interest and potential for conversion. In such cases, despite the outbound origin, the lead’s behaviour aligns more closely with that of an inbound lead, showcasing the fluid nature of the customer journey.

Marketing and sales co-ordination

The blurring lines between inbound and outbound necessitate a seamless coordination between marketing and sales teams. Recognising when outbound efforts lead to inbound behaviour allows both teams to understand the customer journey more comprehensively.

This understanding is crucial for allocating resources effectively and optimising strategies. Marketing teams can craft outbound campaigns designed to trigger inbound engagement, while sales teams can prioritise leads based on their engagement levels, regardless of how their journey began.

Conclusion

The lines between inbound and outbound leads are fluid. A highly engaged audience initially targeted through outbound strategies should transform into inbound leads as they seek further engagement with the business.

Especially in the case of high-value B2B purchases, this evolution underscores the importance of the approach and that continual effort is required to create inbound engagement.

When this is achieved, businesses will create more effective and cohesive sales and marketing strategies catering for the dynamic nature of customer engagement.

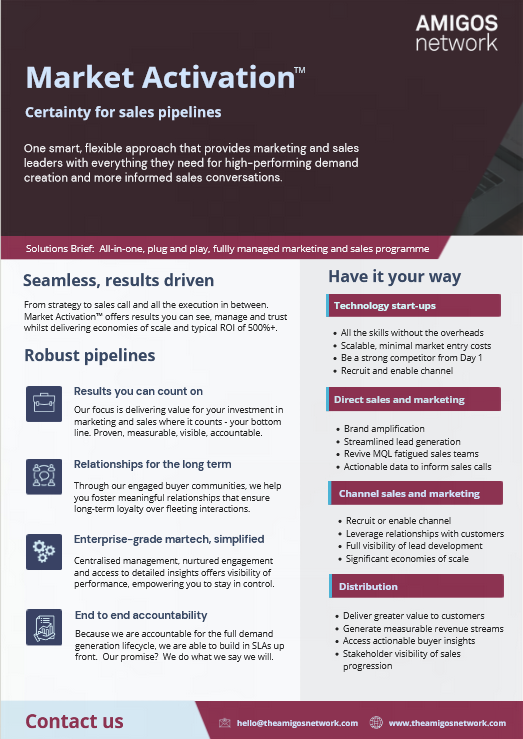

Market Activation™ Solution Brief

Some more detail about how we approach demand generation to get outstanding results.

For more information and a live demonstration of lead progression and pipeline visibility, please book some time with us to show you.

Download (1.3 MB)Frequently Asked Questions

Market Activation identifies in-market buyers (via intent data, behavioural signals) and immediately engages them with tailored outreach (nurture tracks, one-to-one advisor sessions, community invites).

Demand Engine: Targeted outreach (email, ads, sponsorships) that scores clicks → qualified leads → sales-ready appointments.

Performance Dashboard: Real-time visibility into open rates, CTOR, CPL and lead progression via our online sales portal.

Content Amplification: Thought leadership shared in The Amigos Network drives deeper engagement and social proof.

Peer Validation: Prospects get candid feedback from peers on your solutions, shortening the evaluation cycle.

Pipeline Catalysis: Warm introductions and referral paths within the community fuel high- intent conversations.

- Top-of-Funnel: Build credibility through community content and events.

- Mid-Funnel: Leverage peer case studies, expert Q&As, and live demos to answer deep technical questions.

- Bottom-of-Funnel: Invite high-intent members to advisory councils or private 1:1 sessions, often the final nudge before purchase.

- Interesting content: We originate, curate, and syndicate different types of content we know our audiences want to engage with and tell them it’s there.

- Sponsored content: We use sponsored content to drive engagement with individual brands.

- Promotion: We promote that content via multiple channels such as email, social media, YouTube, and so on.

- Identification: We ingest company-level engagement signals and combine it with known contacts that may be researching key topics.

- Segmentation: Members are bucketed by level of intent (high, medium, low) plus ICP fit and company size.

- Activation: High-intent members receive prioritised community invitations (events, focus groups, product deep-dives) to accelerate deals.

- Purchased data highlights who’s in-market.

- Community engagement reveals what questions they’re asking, so your nurture can be hyper-relevant.

- Result: A 2–3× lift in meeting acceptance and pipeline velocity vs. cold outreach alone.

- Marketing owns the nurture tracks, community invites, educational content, and event promos.

- Sales intervenes only at “high-intent + active community engagement” thresholds, with account-specific demos and peer introductions.

- Outcome: Fewer wasted calls and a higher win rate on truly qualified opportunities.

- Engagement Metrics: Community log-ins, event attendance, content downloads.

- Intent Conversion: % of intent-scored members who join private roundtables or request demos.

- Pipeline Velocity: Time from first community touch to opportunity creation.

- Revenue Impact: Contribution of community-sourced deals to overall bookings.

- Average Weekly Open Rate: 40%

- Average Weekly Click-to-Open Rate: 70%

- Average Cost-per-Lead: £45

- Minimum ROI: 500%

- Average Dwell Times: 1 minute 45 seconds